May 30--Nearly 800 Canadians will jam a hotel ballroom near the Toronto airport Sunday to hear the gospel of Florida real estate.

High-end Brazilian buyers prefer to be wooed more intimately -- perhaps at a cocktail party or a small private dinner -- but they are just as pumped.

Lured by rock-bottom prices, international buyers are now flocking to buy Florida properties. It's especially true in countries where the currency is strong against the dollar.

"We're telling Canadians this is a once-in-a-lifetime opportunity -- the perfect storm," said Brian Ellis, who heads Toronto-based Florida Home Finders of Canada. "The prices are just incredible and the Canadian dollar has been so strong."

At least three of five buyers in the Greater Downtown Miami condo market are coming from abroad, estimates Jenny Huertas, international sales director for Condo Vultures, a real estate advisory and research firm.

The stampede from overseas is "kind of like a foreign subsidy helping us resolve our real estate problems," said Peter Zalewski, a Condo Vultures principal. "This time the assistance isn't coming from Washington. It's coming from Caracas, London, Milan, Bogota."

The buying frenzy was set off by developers lowering prices on new units to below what it cost to build in today's market, Huertas said.

"There were many people on the sidelines watching for the floor. In the last three or four months there's the perception that we're there," said developer Edgardo Defortuna, president and chief executive of Fortune International.

CASH CUSTOMERS

Most of the foreigners are cash buyers like Leroy Jean Francois, who has snapped up 47 properties since January for the two real estate firms he works for in France and Switzerland. The plan, he said, is to buy, fix up if necessary, rent out for the next five years, then sell -- for a profit.

The Frenchman has already made a paper profit on a unit he closed on in January at Marquis Residences, a 67-story luxury tower in downtown Miami where prices for a one-bedroom apartment start at $375,000. His unit cost $317 per square foot -- "a great price, incredible," he said.

A recent plunge in the euro -- it's now worth $1.23, down from its high of more than $1.60 in 2008 -- could cool things off a little. To buy a $1 million condo, it now takes around 814,000 euros compared to 625,000 euros under the old exchange rate.

Meantime, prices at Marquis Residences also have strengthened to around $400 per square foot.

But even the declining euro has barely given Francois pause.

"I think the euro will weaken more. But even if the exchange rate is $1 to 1 euro, South Florida real estate is still a great bargain for us," said Francois, who is president of The Bridge, a real estate fund consultancy.

AVERAGE JOES

Luxury condos are once again popular among Latin America buyers who purchase them as investments but also as a home base while their children attend school here, they attend to business interests or escape strife at home.

But for his Canadian buyers, Ellis scours South Florida for condo units at around the $150,000 price point. "We're basically the Wal-Mart. We're for the average Joe."

And these days average Joe Canadian can afford much more. For decades the U.S. dollar was worth more than the Canadian dollar and buying in the U.S. was always more expensive for Canadians. But in September 2007, the Canadian dollar reached parity with the greenback for the first time in 31 years. It fell back again, but now the Canadian loonie, which takes its name from the loon pictured on the one-dollar coin, is near parity at around 95 cents.

So Ellis has been offering his Florida real estate seminars to packed houses in Ontario and is thinking about taking the show on the road to Montreal. There was so much interest in the latest seminar that he had to schedule two sessions for 400 people each this Sunday.

Most of his Canadian buyers are what Ellis calls "end-vestors," meaning they plan on renting a unit out for now with an eye toward using it themselves down the road.

Since Home Finders is licensed as a brokerage only in Canada, it works with Florida brokers who complete the sales and pay the Canadian firm referral fees. By year's end, Ellis said he expects to have facilitated 500 Florida closings.

PRICES HALVED

Though Home Finders is now working with one Sunny Isles Beach property where condos are listed for up to $350,000, the Sun Vista Gardens in Tamarac is a more typical offering.

There, buyers can find a one-bedroom for under $75,000 and a two-bedroom for under $100,000. That same one-bedroom, used to cost $190,000, according to Florida Home Finders' website.

Ellis said he's actually having a hard time coming up with enough Florida properties in the $150,000 range. Of course, he's picky. He's looking for good value, a good location and properties without legal complications. Most of the Canadians want condos, but Ellis said he has some requests for single-family homes.

Though buyers from Europe, Latin America -- most from Argentina, Brazil, Colombia, and Venezuela -- and Canada predominate in the South Florida market, a smattering of Chinese investors and African buyers also are starting to make purchases.

"We recently sold a $7.5 million penthouse at Jade Ocean to a Nigerian buyer," said Defortuna. "They were here and they loved it."

CHINA, TOO

At Fortune's 237-unit Artech building, Defortuna said 11 condos were sold to Chinese investors. Units in the building are selling for almost half of the original asking price.

"I think China is still a marginal market," said Defortuna. "The Chinese are more focused on the West Coast and New York, but small pockets [of Chinese buyers] can make a big difference in a building."

With international offices in Mexico and Argentina, Fortune can tap directly into those markets, and it frequently holds seminars on the legal and financial aspects of owning property in the United States. At one recent event in Buenos Aires there was space for just 200 people, so Fortune decided to charge a $60 fee. "We still had to close reservations," said Defortuna.

One big concern of foreign buyers is what happens to their properties when they lock up after a vacation, said Defortuna. But Fortune International's property management division will take care of things like paying utilities and condo fees -- and even turn over a client's car engine once a week so the battery doesn't die.

A number of local brokerages have country specialists on staff who work with their counterparts abroad to bring in buyers.

Elite Global Reality, for example, has sales associates who specialize in the French, Italian and Chilean markets, said Thiago Costa, executive director and sales associates.

Costa, who is Brazilian, travels frequently to his homeland where local partners have set up meetings with potential buyers in Sao Paulo, Rio de Janeiro or Belo Horizonte who are "willing and able to buy."

He prefers to present one South Florida project at a time to 10 to 20 people at a cocktail party or even a dinner at the home of a potential buyer.

With Miami prices so low, the Brazilian currency (the real) strong, the Brazilian economy robust and real estate prices on the rise in cities like Sao Paulo, where a luxury property might cost $800 to $1,000 per square foot, Brazilians like what they see in South Florida.

'IMPOSSIBLE TO LOSE'

"They feel it's almost impossible to lose money," said Costa.

Africa Israel USA, the New York-based developer of the 292-unit Marquis Residences, also works with the brokerage community in target markets like Venezuela, the South of France, Mexico and Brazil. Working with brokers, it has put on events ranging from fashion shows to invitation-only cocktail parties and dinners, said Lori Odover, the managing director.

"It needs to be someone they know, that they have a one-on-one relationship," she said. So that means even an event at a synagogue or someone's uncle's pool party can be a selling opportunity.

Though most international buyers pay cash, there's an international financing program at Marquis that has proven popular. Some 57 percent of Marquis' foreign buyers have chosen it.

While the program's 45 percent down payment for a five-year ARM seems steep, Bob Wuan, managing director of Americore Mortgage/Vacation Finance, said, "We find international buyers are more than willing to put 50 percent or more down. They want to put money in U.S. real estate as a currency hedge or an inflation hedge."

Meanwhile, Ellis keeps telling Canadians what a great deal Florida is: "We believe Florida is in for quite a rebound. We just don't know when."

Source: http://www.americanchronicle.com/articles/yb/145584684

By Mimi Whitefield, The Miami Herald

The Criscitos has been selling South Florida luxury and commercial real estate for over a decade and has sold over $1 billion dollars of property. They work as a multi-lingual team speaking english, Spanish, Italian and Portuguese. They carved out a niche as a leading boutique real estate company with two distinct divisions -residential and commercial- both personally overseeing by Marcela and Anthony Criscito.

Monday, May 31, 2010

Foreign buyers are flocking to Florida condos again

Miami, Miami Beach, real estate

downtown,

homes,

miami,

miami beach,

prices

Thursday, May 27, 2010

Home purchase negotiations shouldn't end at price

Buyers and sellers who haggle over price alone could be leaving a lot on the table.

The purchase price is only one part of the transaction. Everything in a real-estate deal is open to negotiation, and sometimes price isn't the most important factor.

A buyer might be willing to pay a little more to move into the house within 30 days, for example, instead of waiting until the seller finds another place to live. Similarly, a seller might take less if he could stay longer.

Which appliances stay with the house can sometimes be a sticking point that makes or breaks a deal. Whether or not the seller will help pay the buyer's closing costs is another. If the seller provides a so-called "warranty" is another.

Here are some of the bargaining points each side should consider:

• Earnest money. Buyers are usually asked to attach a check to an offer. But such a deposit also can be used to compensate the seller if the purchaser withdraws from the deal without a legally suitable reason.

Consequently, the seller should seek as large a deposit as possible. It may provide some bargaining room later if you need it. And besides, you can always go lower if a good offer presents itself.

If the closing is set far into the future — say, anywhere from three to six months — you might want to demand an even larger deposit because your home will, in effect, be off the market for that prolonged period.

Buyers, on the other hand, want to be certain the full return of the deposit is tied to contingencies in the contract.

• Financing. Unless they are for all cash, almost all offers are predicated upon the buyer's ability to secure funding. But the seller should be certain the financing contingency is based on reasonable economic conditions.

A financing clause is usually in two parts: 1) that the buyer secures funding within a certain number of days and 2) that the mortgage rate will be no more than a certain percentage. In each instance, your agent should be able to advise you about what is reasonable for current economic conditions.

But seller beware: Make sure that the buyer applies for a mortgage right away so that if he can't qualify, the house can be put back on the market without too much time being lost. Consequently, the timing portion of this condition shouldn't be too long, certainly no longer than a few weeks at the most.

Also, if the rate portion of this contingency is set too low, the house might be under contract but the contract may be all but worthless because there's no way any buyer will find a rate that far below the market.

If the offer is for cash, the buyer may want to seek a somewhat lower price because the sale is all but guaranteed to go through.

• Backups. Even though a seller has accepted an offer, he should entertain others as backup contracts in case the first one goes sour. But to give yourself the opportunity to select the next-best offer, or hunt for even better offers, don't accept other contracts in any particular order.

• Inspections. As a marketing tool, sellers sometimes hire an independent third-party inspector to give their homes a clean bill of health. But it is usually the buyer who wants the house looked over from top to bottom. That way, if the water heater is on its deathbed or the heat exchanger is cracked, they can use the inspector's findings to renegotiate.

Also, just in case the findings are not to his liking, the buyer will want his deposit returned promptly and in full.

At the same time, the seller should require that the inspection be done promptly so the property is not put in limbo.

• Closing costs. Sellers often pay part — and sometimes all — of their buyers' escrow fees, things like a title search, termite inspection, survey and the like. The exact amount or percentage is usually dictated by local custom. But it's all open to negotiation.

• Fixtures. Items such as wall-to-wall carpeting, window treatments and ranges are not part of the structure. But they are attached to it so they are generally considered to be fixtures that convey with the property. But these and plenty of other items can be key bargaining tools. And whatever you agree on, make sure it is spelled out clearly in the contract.

The seller will want to list what does not convey with title as "not included in the sale," and the buyer will want to list everything that stays with the property.

Source: http://www.sun-sentinel.com/business/realestate/fl-home-price-haggling,0,174086.story

By Lew Sichelman

Los Angeles Times

The purchase price is only one part of the transaction. Everything in a real-estate deal is open to negotiation, and sometimes price isn't the most important factor.

A buyer might be willing to pay a little more to move into the house within 30 days, for example, instead of waiting until the seller finds another place to live. Similarly, a seller might take less if he could stay longer.

Which appliances stay with the house can sometimes be a sticking point that makes or breaks a deal. Whether or not the seller will help pay the buyer's closing costs is another. If the seller provides a so-called "warranty" is another.

Here are some of the bargaining points each side should consider:

• Earnest money. Buyers are usually asked to attach a check to an offer. But such a deposit also can be used to compensate the seller if the purchaser withdraws from the deal without a legally suitable reason.

Consequently, the seller should seek as large a deposit as possible. It may provide some bargaining room later if you need it. And besides, you can always go lower if a good offer presents itself.

If the closing is set far into the future — say, anywhere from three to six months — you might want to demand an even larger deposit because your home will, in effect, be off the market for that prolonged period.

Buyers, on the other hand, want to be certain the full return of the deposit is tied to contingencies in the contract.

• Financing. Unless they are for all cash, almost all offers are predicated upon the buyer's ability to secure funding. But the seller should be certain the financing contingency is based on reasonable economic conditions.

A financing clause is usually in two parts: 1) that the buyer secures funding within a certain number of days and 2) that the mortgage rate will be no more than a certain percentage. In each instance, your agent should be able to advise you about what is reasonable for current economic conditions.

But seller beware: Make sure that the buyer applies for a mortgage right away so that if he can't qualify, the house can be put back on the market without too much time being lost. Consequently, the timing portion of this condition shouldn't be too long, certainly no longer than a few weeks at the most.

Also, if the rate portion of this contingency is set too low, the house might be under contract but the contract may be all but worthless because there's no way any buyer will find a rate that far below the market.

If the offer is for cash, the buyer may want to seek a somewhat lower price because the sale is all but guaranteed to go through.

• Backups. Even though a seller has accepted an offer, he should entertain others as backup contracts in case the first one goes sour. But to give yourself the opportunity to select the next-best offer, or hunt for even better offers, don't accept other contracts in any particular order.

• Inspections. As a marketing tool, sellers sometimes hire an independent third-party inspector to give their homes a clean bill of health. But it is usually the buyer who wants the house looked over from top to bottom. That way, if the water heater is on its deathbed or the heat exchanger is cracked, they can use the inspector's findings to renegotiate.

Also, just in case the findings are not to his liking, the buyer will want his deposit returned promptly and in full.

At the same time, the seller should require that the inspection be done promptly so the property is not put in limbo.

• Closing costs. Sellers often pay part — and sometimes all — of their buyers' escrow fees, things like a title search, termite inspection, survey and the like. The exact amount or percentage is usually dictated by local custom. But it's all open to negotiation.

• Fixtures. Items such as wall-to-wall carpeting, window treatments and ranges are not part of the structure. But they are attached to it so they are generally considered to be fixtures that convey with the property. But these and plenty of other items can be key bargaining tools. And whatever you agree on, make sure it is spelled out clearly in the contract.

The seller will want to list what does not convey with title as "not included in the sale," and the buyer will want to list everything that stays with the property.

Source: http://www.sun-sentinel.com/business/realestate/fl-home-price-haggling,0,174086.story

By Lew Sichelman

Los Angeles Times

Miami, Miami Beach, real estate

business,

haggling over details beyond price offers rewards for both sides,

In home sale negotiations,

real estate

Wednesday, May 26, 2010

South Florida Homes - and prices - rise

After nearly three years of freefall, South Florida single-family home prices tried something new in April: They went up.

In a sign that the ailing real estate market could be heading in a healthier direction, the median sale price of existing homes in Miami-Dade and Broward increased compared with last April, according to data released Monday by the trade group Florida Realtors.

Home sales also crept up, fueled by bargains on troubled properties, low mortgage rates and a deadline for thousands of dollars in tax credits.

``There's no question that the market has been strengthening,'' said Ron Shuffield, president of Esslinger-Wooten-Maxwell Realtors.

In Miami-Dade, the year-over-year median home price increased by 8 percent to $192,000, while the jump was 7 percent in Broward, to $204,300. Existing Miami-Dade home sales rose 7 percent over last April to 594. In Broward, sales increased 11 percent to 766.

Condo sales had big jumps over last year, but with plenty of inventory still to choose from, prices continued to fall. In Miami-Dade, 723 units sold, a 33 percent increase over the same time a year ago. But the median price dropped 3 percent to $130,000. Broward condo prices dropped a percent to $79,300, with 1,077 selling -- an increase of 30 percent over April 2009.

All this follows last week's positive news on the job front. Florida's unemployment rate dropped to 12 percent in April after 49 months of increases.

``It is a lot more exciting now,'' said Jay Reichbaum, general manager at Jeanne Baker International Realty in Coconut Grove. ``Things are definitely looking a little brighter.''

Still, he called the mood ``hopefully optimistic'' rather than all-out celebratory. ``Most of us who've been doing this for awhile feel like we probably won't get back to a real market until 2011 at least.''

Foreign buyers, mostly Canadians armed with cash, have been driving sales in Hollywood, Hallandale Beach and Sunny Isles Beach for Realtor Genevieve Bouchard.

``It was really, really great,'' said Bouchard, who said the big sellers are condos between $150,000-$300,000. ``I wish all my months were like that.''

Nationally, home sales outpaced expectations for April with the temporary boost of an $8,000 tax credit for first-time buyers and $6,500 credit for repeat buyers. The deadline to sign a contract was April 30; buyers must close by the end of June.

The National Association of Realtors said Monday that sales of previously owned homes rose 7.6 percent to a seasonally adjusted annual rate of 5.77 million, the best showing in five months.

Home prices also increased from a year ago, with the median price up 4 percent to $173,100.

If you put a microscope to the numbers, the month-to-month figures show less clarity. April's numbers were either only slightly better or worse than March's. Broward single-family home sales were up 4 percent from March, while prices dropped 4.5 percent. Miami-Dade sales dipped 8.5 percent and prices were down nearly 3 percent.

Miami-Dade condo sales were down 13 percent, with prices down 6 percent from March. Condo sales in Broward dropped 5.5 percent month over month, though prices increased almost 8 percent.

Expert opinions on Monday's news ranged from skeptical to the ``I told you so'' variety.

``I think it's a blip,'' said independent housing analyst Jack McCabe, CEO of McCabe Research & Consulting. ``A lot of times when we compare these monthly numbers from the Realtors association to a year ago, they're highly volatile.''

He pointed to foreclosures that haven't hit the market and predicted a drop in sales later this year once all the tax credit-fueled purchases close.

But real estate analyst, appraiser and advisor Michael Y. Cannon said he was wasn't surprised by the increase in sales and prices.

``The market is coming back to its equilibrium,'' he said.

Cannon, executive director of Integra Realty Resources -- Miami, said some markets -- Coral Gables, Miami Beach and part of Coconut Grove, for example -- have kept their prices up, and even some investors are finding value in flipping foreclosures.

EWM's Shuffield said it is too early to predict whether sales prices will continue to increase, but said the figures should bring confidence to the homeowners.

``I don't think anybody is anticipating that we're going to see peak prices again anytime soon,'' he said. ``But I think if we can just begin to get back to a normal increase of 4, 5, 6 percent annually in value, then people would be very pleased.''

Physician's assistant Krysten Riordan ``probably looked at close to 100 houses'' before signing a contract for a four-bedroom home in Davie in April. She's waiting for bank approval.

Riordan, 32, said low interest rates and fair prices spurred her to make her move.

``For me, I think everything fell into place at the right time.''

Source: http://www.miamiherald.com/2010/05/24/1646315/home-sweet-home-with-rising-sales.html

BY HANNAH SAMPSON

hsampson@MiamiHerald.com

In a sign that the ailing real estate market could be heading in a healthier direction, the median sale price of existing homes in Miami-Dade and Broward increased compared with last April, according to data released Monday by the trade group Florida Realtors.

Home sales also crept up, fueled by bargains on troubled properties, low mortgage rates and a deadline for thousands of dollars in tax credits.

``There's no question that the market has been strengthening,'' said Ron Shuffield, president of Esslinger-Wooten-Maxwell Realtors.

In Miami-Dade, the year-over-year median home price increased by 8 percent to $192,000, while the jump was 7 percent in Broward, to $204,300. Existing Miami-Dade home sales rose 7 percent over last April to 594. In Broward, sales increased 11 percent to 766.

Condo sales had big jumps over last year, but with plenty of inventory still to choose from, prices continued to fall. In Miami-Dade, 723 units sold, a 33 percent increase over the same time a year ago. But the median price dropped 3 percent to $130,000. Broward condo prices dropped a percent to $79,300, with 1,077 selling -- an increase of 30 percent over April 2009.

All this follows last week's positive news on the job front. Florida's unemployment rate dropped to 12 percent in April after 49 months of increases.

``It is a lot more exciting now,'' said Jay Reichbaum, general manager at Jeanne Baker International Realty in Coconut Grove. ``Things are definitely looking a little brighter.''

Still, he called the mood ``hopefully optimistic'' rather than all-out celebratory. ``Most of us who've been doing this for awhile feel like we probably won't get back to a real market until 2011 at least.''

Foreign buyers, mostly Canadians armed with cash, have been driving sales in Hollywood, Hallandale Beach and Sunny Isles Beach for Realtor Genevieve Bouchard.

``It was really, really great,'' said Bouchard, who said the big sellers are condos between $150,000-$300,000. ``I wish all my months were like that.''

Nationally, home sales outpaced expectations for April with the temporary boost of an $8,000 tax credit for first-time buyers and $6,500 credit for repeat buyers. The deadline to sign a contract was April 30; buyers must close by the end of June.

The National Association of Realtors said Monday that sales of previously owned homes rose 7.6 percent to a seasonally adjusted annual rate of 5.77 million, the best showing in five months.

Home prices also increased from a year ago, with the median price up 4 percent to $173,100.

If you put a microscope to the numbers, the month-to-month figures show less clarity. April's numbers were either only slightly better or worse than March's. Broward single-family home sales were up 4 percent from March, while prices dropped 4.5 percent. Miami-Dade sales dipped 8.5 percent and prices were down nearly 3 percent.

Miami-Dade condo sales were down 13 percent, with prices down 6 percent from March. Condo sales in Broward dropped 5.5 percent month over month, though prices increased almost 8 percent.

Expert opinions on Monday's news ranged from skeptical to the ``I told you so'' variety.

``I think it's a blip,'' said independent housing analyst Jack McCabe, CEO of McCabe Research & Consulting. ``A lot of times when we compare these monthly numbers from the Realtors association to a year ago, they're highly volatile.''

He pointed to foreclosures that haven't hit the market and predicted a drop in sales later this year once all the tax credit-fueled purchases close.

But real estate analyst, appraiser and advisor Michael Y. Cannon said he was wasn't surprised by the increase in sales and prices.

``The market is coming back to its equilibrium,'' he said.

Cannon, executive director of Integra Realty Resources -- Miami, said some markets -- Coral Gables, Miami Beach and part of Coconut Grove, for example -- have kept their prices up, and even some investors are finding value in flipping foreclosures.

EWM's Shuffield said it is too early to predict whether sales prices will continue to increase, but said the figures should bring confidence to the homeowners.

``I don't think anybody is anticipating that we're going to see peak prices again anytime soon,'' he said. ``But I think if we can just begin to get back to a normal increase of 4, 5, 6 percent annually in value, then people would be very pleased.''

Physician's assistant Krysten Riordan ``probably looked at close to 100 houses'' before signing a contract for a four-bedroom home in Davie in April. She's waiting for bank approval.

Riordan, 32, said low interest rates and fair prices spurred her to make her move.

``For me, I think everything fell into place at the right time.''

Source: http://www.miamiherald.com/2010/05/24/1646315/home-sweet-home-with-rising-sales.html

BY HANNAH SAMPSON

hsampson@MiamiHerald.com

Miami, Miami Beach, real estate

condo,

condominiums,

Home,

miami,

miami beach

Monday, May 24, 2010

Miami Condominiums See Improving Occupancy And Sales Transactions

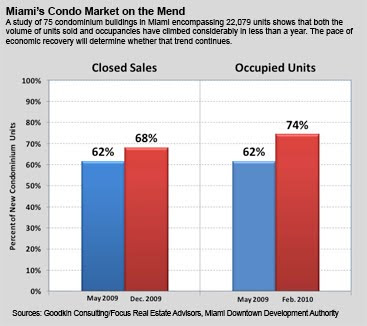

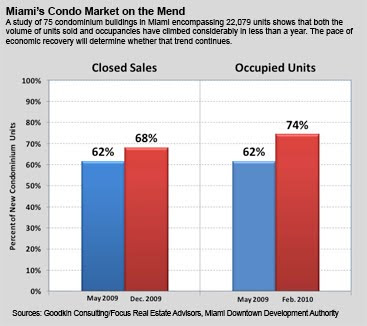

Clouds are lifting over Miami’s beleaguered condo market following a boom-and-bust cycle of epic proportions. According to a recent study commissioned by the City of Miami’s Downtown Development Authority (DDA) and conducted in partnership with Goodkin Consulting and Focus Real Estate Advisors LLC, condo sales and occupancy rates are on the rise.

“We’re coming out of the most prolific overbuilding in the history of Southeast Florida,” says Jonathan Kingsley, executive vice president and managing director at brokerage firm Grubb & Ellis.

The Residential Closings and Occupancy Study, published in March 2010, updated a similar report issued in June 2009. Both studies examined 75 completed condominium buildings located in a 60-block area in downtown Miami . Many of the buildings adorn prestigious Brickell Avenue and other units overlooking Biscayne Bay .

The study found that in February 2010, 74% of the 22,079 units built since 2003 were occupied versus 62% in May 2009. An average of 345 units were leased monthly last year.

Full-time residents occupy 87% of the 16,415 units. Of those units, a little more than half (52%) are rented. “There’s a younger crowd, new businesses and lots more after hours people,” notes Alyce Robertson, the DDA’s executive director.

Sales also increased. More than 15,000 of the existing units, or 68%, were sold at the end of 2009 compared with 62% in May 2009. Average monthly sales in the downtown Miami area totaled 350 units in the fourth quarter of last year, a whopping gain of more than 200% over the fourth quarter of 2008.

Approximately 7,000 condo units remain on the downtown market. If current trends continue, the study predicts that all of downtown Miami’s existing condo inventory could be occupied within 25 months.

Tempering the exuberance

“There’s been a movement to the downtown area based on affordability that didn’t exist previously,” explains Craig Worley, president of Focus Real Estate Advisors. However, he cautions the projections depend on employment stability and job creation. “We’re not out of the woods yet,” he says.

Other caveats: A significant number of buyers were investors “looking for an appreciation play,” Worley explains, “so potentially a large number of units could be fed back onto the market.” And rental rates across the board generally “don’t provide a positive cash flow to cover homeowner association fees and taxes.”

Jack McCabe, CEO of McCabe Research and Consulting based in Deerfield Beach, Fla., agrees. “When you peel back the skin it isn’t so pretty,” he says. “We’ve seen sales pick up — primarily cash deals to bulk investors and international buyers — at deeply discounted prices. It’s basically a cash buyers’ market.”

McCabe adds that prices have fallen some 50% to 70% to $200 to $250 per sq. ft. from a high of $500 to $600 per sq. ft. at the market’s peak.

Sales of existing condos in Miami increased 46% to 1,920 units sold compared with 1,311 in the first quarter of 2009, according to the Florida Association of Realtors. However, the median price fell 9% to $136,100 compared with $149,000 a year earlier.

Financing hurdles remain

Peter Zalewski, founder of Condo Vultures Realty LLC, a firm specializing in condo sales, research and consulting, reports only 17% of the 713 new condos sold during the first quarter in the greater downtown Miami area obtained financing.

The remaining sales were cash transactions. He estimates that only approximately one out of four transactions involve primary users; the remaining units are sold to speculators with cash. Like many other observers, Zalewski says the impact of the first-time homebuyer tax credit was minimal.

Recently Fannie Mae and Freddie Mac announced plans to ease existing stringent guidelines to provide more financing for Florida’s condo market. In January, Fannie Mae introduced the Special Approval Designation program and assigned a team of six professionals to review existing condo projects that previously failed to qualify for the agency’s financing because of foreclosures , high vacancy rates, unpaid homeowner association fees and other expenses.

If the team awards a building a Special Approval Designation, lenders can originate and deliver mortgages to the agency. “It’s setting the scene,” Zalewski says. “The dividend will be paid in 2011.”

Source: http://www.nuwireinvestor.com/articles/miami-condominiums-see-improving-occupancy-and-sales-transactions-55246.aspx

Written by: Jody Fidler

“We’re coming out of the most prolific overbuilding in the history of Southeast Florida,” says Jonathan Kingsley, executive vice president and managing director at brokerage firm Grubb & Ellis.

The Residential Closings and Occupancy Study, published in March 2010, updated a similar report issued in June 2009. Both studies examined 75 completed condominium buildings located in a 60-block area in downtown Miami . Many of the buildings adorn prestigious Brickell Avenue and other units overlooking Biscayne Bay .

The study found that in February 2010, 74% of the 22,079 units built since 2003 were occupied versus 62% in May 2009. An average of 345 units were leased monthly last year.

Full-time residents occupy 87% of the 16,415 units. Of those units, a little more than half (52%) are rented. “There’s a younger crowd, new businesses and lots more after hours people,” notes Alyce Robertson, the DDA’s executive director.

Sales also increased. More than 15,000 of the existing units, or 68%, were sold at the end of 2009 compared with 62% in May 2009. Average monthly sales in the downtown Miami area totaled 350 units in the fourth quarter of last year, a whopping gain of more than 200% over the fourth quarter of 2008.

Approximately 7,000 condo units remain on the downtown market. If current trends continue, the study predicts that all of downtown Miami’s existing condo inventory could be occupied within 25 months.

Tempering the exuberance

“There’s been a movement to the downtown area based on affordability that didn’t exist previously,” explains Craig Worley, president of Focus Real Estate Advisors. However, he cautions the projections depend on employment stability and job creation. “We’re not out of the woods yet,” he says.

Other caveats: A significant number of buyers were investors “looking for an appreciation play,” Worley explains, “so potentially a large number of units could be fed back onto the market.” And rental rates across the board generally “don’t provide a positive cash flow to cover homeowner association fees and taxes.”

Jack McCabe, CEO of McCabe Research and Consulting based in Deerfield Beach, Fla., agrees. “When you peel back the skin it isn’t so pretty,” he says. “We’ve seen sales pick up — primarily cash deals to bulk investors and international buyers — at deeply discounted prices. It’s basically a cash buyers’ market.”

McCabe adds that prices have fallen some 50% to 70% to $200 to $250 per sq. ft. from a high of $500 to $600 per sq. ft. at the market’s peak.

Sales of existing condos in Miami increased 46% to 1,920 units sold compared with 1,311 in the first quarter of 2009, according to the Florida Association of Realtors. However, the median price fell 9% to $136,100 compared with $149,000 a year earlier.

Financing hurdles remain

Peter Zalewski, founder of Condo Vultures Realty LLC, a firm specializing in condo sales, research and consulting, reports only 17% of the 713 new condos sold during the first quarter in the greater downtown Miami area obtained financing.

The remaining sales were cash transactions. He estimates that only approximately one out of four transactions involve primary users; the remaining units are sold to speculators with cash. Like many other observers, Zalewski says the impact of the first-time homebuyer tax credit was minimal.

Recently Fannie Mae and Freddie Mac announced plans to ease existing stringent guidelines to provide more financing for Florida’s condo market. In January, Fannie Mae introduced the Special Approval Designation program and assigned a team of six professionals to review existing condo projects that previously failed to qualify for the agency’s financing because of foreclosures , high vacancy rates, unpaid homeowner association fees and other expenses.

If the team awards a building a Special Approval Designation, lenders can originate and deliver mortgages to the agency. “It’s setting the scene,” Zalewski says. “The dividend will be paid in 2011.”

Source: http://www.nuwireinvestor.com/articles/miami-condominiums-see-improving-occupancy-and-sales-transactions-55246.aspx

Written by: Jody Fidler

Miami, Miami Beach, real estate

condo,

condominiums,

Home,

homes,

improve,

miami,

miami beach,

sales,

transactions

Thursday, May 20, 2010

What to watch for when buying a vacant home

When it comes to the housing market for foreclosures - buyer beware.

"One mistake that we see all the time is buyers going in and assuming all the mechanicals are working," said Brandon T. Johnson, president of GTJ Consulting in Roseville, Mich. "You have to be careful you don't get burned that way."

Johnson's company maintains foreclosed homes for a number of lenders, Realtors and Freddie Mac. He said the term "as is" shouldn't scare buyers off as long as they know what it means. He recommends that buyers get private inspections on houses they want to buy to avoid surprises such as missing plumbing or water damage.

Here's a list of 10 things to watch for in foreclosed or vacant homes from Ross Kollenberg, mitigation and construction manager for On-Site Specialty Cleaning & Restoration in Troy, Mich:

1. Air quality. This tells a lot about the home's condition. Include air and surface testing in your home inspection. It is a few hundred dollars well spent.

2. Black cobwebs, greasy gray residue on walls and/or a strong oily odor. This is soot damage, which requires professional cleaning, and points to a malfunctioning furnace. It also could be a tip-off that the home had a fire.

3. Discolored subflooring. From the basement, check the subflooring above for stains and small holes, both caused by mold.

4. An older home with extensive renovations. Check with the city for permits: You'll get remodeling details. If asbestos or lead paint is present and has been disturbed, be sure it's been remediated by a certified specialist. It the home has four or five major changes, it may not be up to code, and that could mean extensive fixes for the next owner.

5. Peeling, bubbling, and discolored paint; swelling in walls or ceilings (especially around kitchens and bathrooms); a musty odor: All indicate water damage and, potentially, the presence of moisture and mold.

6. Missing sinks, toilets and other fixtures. Sometimes the previous owner will take the fixtures with them, but won't shut off the pipes or will rip fixtures from the wall. If a pipe was cracked during the fixture removal, it could start a slow leak in the wall that isn't easily seen. Make sure those fixtures have been properly removed and not ripped from walls and floors.

7. Fungus growth inside cabinets, behind drawers and built-ins. That could mean there has been water damage. Since water falls down, look for the source above the mold. One trick inspectors use to determine whether there could be hidden water damage is to pull out the kitchen drawers and look inside to see whether the back wall has been rebuilt. If it has, that could mean water damage has been covered up.

8. Excessive painting of every nook, cranny, door and floor. The seller may be covering up mold. "When you go do a home that is 'landlord white' and the trim is flat, we tell people there is a reason the house was painted this way," Kollenberg said. "When we see it is over everything, it is a tip-off that it is just covering something up."

9. Unheated house in winter months. If the home has been properly winterized, there's no need for heat. If not, pipes will burst and cause water damage. The bulk of houses Kollenberg sees were not properly winterized and had a pipe break or water damage.

10. Blocked drains or pipes. These will cause future problems and may have already created sewage backups. Check for a telltale water ring in the basement, Kollenberg said.

Read more: http://www.miamiherald.com/2010/05/20/1638832/what-to-watch-for-when-buying.html#ixzz0oUcH6vnI

"One mistake that we see all the time is buyers going in and assuming all the mechanicals are working," said Brandon T. Johnson, president of GTJ Consulting in Roseville, Mich. "You have to be careful you don't get burned that way."

Johnson's company maintains foreclosed homes for a number of lenders, Realtors and Freddie Mac. He said the term "as is" shouldn't scare buyers off as long as they know what it means. He recommends that buyers get private inspections on houses they want to buy to avoid surprises such as missing plumbing or water damage.

Here's a list of 10 things to watch for in foreclosed or vacant homes from Ross Kollenberg, mitigation and construction manager for On-Site Specialty Cleaning & Restoration in Troy, Mich:

1. Air quality. This tells a lot about the home's condition. Include air and surface testing in your home inspection. It is a few hundred dollars well spent.

2. Black cobwebs, greasy gray residue on walls and/or a strong oily odor. This is soot damage, which requires professional cleaning, and points to a malfunctioning furnace. It also could be a tip-off that the home had a fire.

3. Discolored subflooring. From the basement, check the subflooring above for stains and small holes, both caused by mold.

4. An older home with extensive renovations. Check with the city for permits: You'll get remodeling details. If asbestos or lead paint is present and has been disturbed, be sure it's been remediated by a certified specialist. It the home has four or five major changes, it may not be up to code, and that could mean extensive fixes for the next owner.

5. Peeling, bubbling, and discolored paint; swelling in walls or ceilings (especially around kitchens and bathrooms); a musty odor: All indicate water damage and, potentially, the presence of moisture and mold.

6. Missing sinks, toilets and other fixtures. Sometimes the previous owner will take the fixtures with them, but won't shut off the pipes or will rip fixtures from the wall. If a pipe was cracked during the fixture removal, it could start a slow leak in the wall that isn't easily seen. Make sure those fixtures have been properly removed and not ripped from walls and floors.

7. Fungus growth inside cabinets, behind drawers and built-ins. That could mean there has been water damage. Since water falls down, look for the source above the mold. One trick inspectors use to determine whether there could be hidden water damage is to pull out the kitchen drawers and look inside to see whether the back wall has been rebuilt. If it has, that could mean water damage has been covered up.

8. Excessive painting of every nook, cranny, door and floor. The seller may be covering up mold. "When you go do a home that is 'landlord white' and the trim is flat, we tell people there is a reason the house was painted this way," Kollenberg said. "When we see it is over everything, it is a tip-off that it is just covering something up."

9. Unheated house in winter months. If the home has been properly winterized, there's no need for heat. If not, pipes will burst and cause water damage. The bulk of houses Kollenberg sees were not properly winterized and had a pipe break or water damage.

10. Blocked drains or pipes. These will cause future problems and may have already created sewage backups. Check for a telltale water ring in the basement, Kollenberg said.

Read more: http://www.miamiherald.com/2010/05/20/1638832/what-to-watch-for-when-buying.html#ixzz0oUcH6vnI

Miami, Miami Beach, real estate

Home,

houses,

miami,

miami beach,

vacant

Wednesday, May 19, 2010

Sales pick up at Miami's Canyon Ranch

Canyon Ranch Living, a luxury wellness hotel and condo development in Miami that has been heavily targeting New York City buyers, sold 49 condo units in the first quarter of the year, spurring optimism that the 1-million-square-foot property is catching on with buyers, according to Mel Zuckerman, the founder and chairman of Canyon Ranch. The complex contains 430 condo units and 150 hotel rooms, as well as a 70,000-square-foot spa. An affiliate company of Lehman Brothers Holdings took ownership of the property in November 2009 for $291 million. So far, 88 units have sold.

Source: http://therealdeal.com/miami/articles/sales-pick-up-at-wellness-residential-complex-in-miami-canyon-ranch

Source: http://therealdeal.com/miami/articles/sales-pick-up-at-wellness-residential-complex-in-miami-canyon-ranch

Monday, May 17, 2010

Cash still king in condo buys

Cash continues to be king when it comes to buying condos.

A new report by Condo Vultures LLC finds that buyers paid cash for nearly 600 units in 29 projects in the greater downtown Miami area from January through March. Fewer than 120 units in 19 projects were financed, according to the Bal Harbour-based real estate consultancy.

"Even though the U.S. government is encouraging lenders to once again finance condo purchases, the results have not been impressive in South Florida," said Peter Zalewski, a principal with Condo Vultures. "Many lenders claim to be willing to consider writing loans for buyers of condominiums, but the end results simply do not support that.”

The report found buyers obtained nearly three-dozen mortgages – the greatest number in the downtown market – in Icon Brickell. Earlier this month, about half of the 1,800 units in the three-tower complex were handed back to the lender.

The next-highest concentration of financed mortgages was at 500 Brickell, across the street from Icon Brickell, according to the report.

The Ivy condominium, on the north bank of the Miami River, rounded out the top three.

Fannie Mae has been working to easing certification guidelines and has created a special team to review applications for new Florida projects seeking approval.

Fannie Mae approved 70 Florida condominiums in the first four months of the year, after approving 146 projects in the state in 2009. That’s significantly better than in 2008 when no Florida condo projects were granted Fannie Mae approval, according to the report.

Source: http://www.bizjournals.com/southflorida/stories/2010/05/17/daily17.html

A new report by Condo Vultures LLC finds that buyers paid cash for nearly 600 units in 29 projects in the greater downtown Miami area from January through March. Fewer than 120 units in 19 projects were financed, according to the Bal Harbour-based real estate consultancy.

"Even though the U.S. government is encouraging lenders to once again finance condo purchases, the results have not been impressive in South Florida," said Peter Zalewski, a principal with Condo Vultures. "Many lenders claim to be willing to consider writing loans for buyers of condominiums, but the end results simply do not support that.”

The report found buyers obtained nearly three-dozen mortgages – the greatest number in the downtown market – in Icon Brickell. Earlier this month, about half of the 1,800 units in the three-tower complex were handed back to the lender.

The next-highest concentration of financed mortgages was at 500 Brickell, across the street from Icon Brickell, according to the report.

The Ivy condominium, on the north bank of the Miami River, rounded out the top three.

Fannie Mae has been working to easing certification guidelines and has created a special team to review applications for new Florida projects seeking approval.

Fannie Mae approved 70 Florida condominiums in the first four months of the year, after approving 146 projects in the state in 2009. That’s significantly better than in 2008 when no Florida condo projects were granted Fannie Mae approval, according to the report.

Source: http://www.bizjournals.com/southflorida/stories/2010/05/17/daily17.html

Miami, Miami Beach, real estate

condominiums,

condos,

Home,

homes,

miami,

miami beach

Thursday, May 13, 2010

US home foreclosures drop first time in four years

US home foreclosures have dropped for the first time in four years as the economy recovered from a brutal recession triggered by a mortgage meltdown, a real estate data company said Thursday.

Foreclosure filings -- default notices, auctions and bank repossessions -- were reported on 333,837 properties in April, a nine percent decrease from the previous month and a two percent decrease from last year, RealtyTrac said.

This was the first year-over-year drop since the company started tracking annual foreclosure rates in January 2006, nearly two years before the US plunged into recession resulting from a home mortgage crisis.

"There were two important milestones in the April numbers that show foreclosure activity has begun to plateau -- but at a very high level that will not drop off in the near future," said James Saccacio, RealtyTrac's chief executive.

"April was the first month in the history of our report with an annual decrease in US foreclosure activity. Secondly, bank repossessions hit a record monthly high for the report even while default notices dropped substantially on a monthly and annual basis," he said.

The company expected a similar pattern for most of this year.

Some 92,432 properties were repossessed by lenders in April -- an increase of one percent from the previous month and 45 percent from 2009.

Bank repossessions were less than one percent above their previous peak of 92,182 in December 2009.

Nevada, Arizona, Florida were hit hard by the mortgage crisis.

Nevada posted the nation's highest state foreclosure rate for the 40th straight month, with one in every 69 housing units receiving a foreclosure filing in April -- more than five times the national average.

Source: http://www.france24.com/en/20100513-us-home-foreclosures-drop-first-time-four-years

Foreclosure filings -- default notices, auctions and bank repossessions -- were reported on 333,837 properties in April, a nine percent decrease from the previous month and a two percent decrease from last year, RealtyTrac said.

This was the first year-over-year drop since the company started tracking annual foreclosure rates in January 2006, nearly two years before the US plunged into recession resulting from a home mortgage crisis.

"There were two important milestones in the April numbers that show foreclosure activity has begun to plateau -- but at a very high level that will not drop off in the near future," said James Saccacio, RealtyTrac's chief executive.

"April was the first month in the history of our report with an annual decrease in US foreclosure activity. Secondly, bank repossessions hit a record monthly high for the report even while default notices dropped substantially on a monthly and annual basis," he said.

The company expected a similar pattern for most of this year.

Some 92,432 properties were repossessed by lenders in April -- an increase of one percent from the previous month and 45 percent from 2009.

Bank repossessions were less than one percent above their previous peak of 92,182 in December 2009.

Nevada, Arizona, Florida were hit hard by the mortgage crisis.

Nevada posted the nation's highest state foreclosure rate for the 40th straight month, with one in every 69 housing units receiving a foreclosure filing in April -- more than five times the national average.

Source: http://www.france24.com/en/20100513-us-home-foreclosures-drop-first-time-four-years

Miami, Miami Beach, real estate

condominiums,

condos,

foreclosure,

Home,

houses,

miami,

miami beach

Wednesday, May 12, 2010

S. Florida Real Estate Trying To Come Back

Aided by low interest rates and federal tax credits, sales of single-family homes and condominiums in South Florida roared during the first three months of 2010.

In Miami-Dade County, sales of condos jumped by 46 percent in the first quarter to 1,920 when compared to the same period of time in 2009. However, median home prices fell almost 10 percent to $136,100 according to numbers from Florida Realtors.

Real estate agents told CBS4 news partner the Miami Herald that buyers who were on the fence before are now signing contracts and renters are deciding to own their own place. Buyers had until April 30 to sign a contract to purchase a primary residence and until June 30 to close on it to qualify federal tax credits.

According to the Herald, fewer than 40,000 condominiums and town houses are now for resale in South Florida. Resale units in South Florida have dropped by 23 percent compared to May 2009.

Source: http://cbs4.com/CBS4yourmoney/real.estate.improvement.2.1689894.html

In Miami-Dade County, sales of condos jumped by 46 percent in the first quarter to 1,920 when compared to the same period of time in 2009. However, median home prices fell almost 10 percent to $136,100 according to numbers from Florida Realtors.

Real estate agents told CBS4 news partner the Miami Herald that buyers who were on the fence before are now signing contracts and renters are deciding to own their own place. Buyers had until April 30 to sign a contract to purchase a primary residence and until June 30 to close on it to qualify federal tax credits.

According to the Herald, fewer than 40,000 condominiums and town houses are now for resale in South Florida. Resale units in South Florida have dropped by 23 percent compared to May 2009.

Source: http://cbs4.com/CBS4yourmoney/real.estate.improvement.2.1689894.html

Miami, Miami Beach, real estate

condominiums,

condos,

Home,

houses,

miami,

miami beach

Monday, May 10, 2010

Pending home sales in South Florida jump

Propelled by low prices, attractive interest rates and federal incentives to lock in offers by the month's end, the number of new contracts on South Florida homes soared in April.

Compared with March, pending sales of single-family homes and condominiums increased last month in both Miami-Dade and Broward, mirroring the national upward trend in contracts signed, according to data released Tuesday by the Realtor Association of Greater Miami and the Beaches. Compared with last April, the number skyrocketed.

Pending home sales track signed contracts that haven't yet closed -- a figure that may have been unusually high for April because buyers had to sign contracts by April 30 to qualify for federal tax credits. To finalize the credit -- $8,000 for first-timers, $6,500 for repeat buyers -- they must close by June 30.

The number of pending home sales overall ticked up by 6.6 percent in Miami-Dade in April, with 10,392 compared with 9,751 in March. In Broward, pending home sales increased from 8,173 in March to 8,525 in April, up 4.3 percent.

Those increases represent huge leaps over last year's numbers. In Miami-Dade, pending sales increased 71 percent year over year; the jump was 64 percent in Broward, figures that point to a recovering market, real estate agents and analysts say.

Sales have increased for the past few months as home prices have fallen.

NEARING BOTTOM?

Independent housing analyst Jack McCabe said the market is likely nearing the bottom, but still must deal with foreclosures and short sales, which keep prices low.

``I think we're going to see a pretty decent year as far as sales numbers, but I don't see prices going up,'' he said.

``The state of paralysis, I think, is pretty much over,'' said Terri Bersach, chairman of the association, which released the data with the Southeast Florida Multiple Listing Service.

Nationally, pending home sales increased in March. The index of sales contracts by the National Association of Realtors rose 5.3 percent from February and 21 percent over last March.

DROP PREDICTED

The national association's chief economist, Lawrence Yun, predicted a drop in sales in the near future.

But South Florida agents say they aren't too concerned about the expired credit.

Jo-Ann Forster, a broker associate with Esslinger Wooten Maxwell, said the tax credit was attractive to buyers looking at less expensive properties.

``If you're going to take all of Miami-Dade into consideration, you're going to see a drop-off,'' Forster said. ``If you take our niche markets, I don't think it's going to have a cataclysmic reaction.''

Anthony Askowitz, a broker and owner of two Re/Max offices, said the timing is good because May and June are typically busy sales months.

``If Miami had a season, this is definitely the big season,'' he said.

Source: http://www.miamiherald.com/2010/05/05/1613443/pending-home-sales-jump.html

By HANNAH SAMPSON

hsampson@MiamiHerald.com

Compared with March, pending sales of single-family homes and condominiums increased last month in both Miami-Dade and Broward, mirroring the national upward trend in contracts signed, according to data released Tuesday by the Realtor Association of Greater Miami and the Beaches. Compared with last April, the number skyrocketed.

Pending home sales track signed contracts that haven't yet closed -- a figure that may have been unusually high for April because buyers had to sign contracts by April 30 to qualify for federal tax credits. To finalize the credit -- $8,000 for first-timers, $6,500 for repeat buyers -- they must close by June 30.

The number of pending home sales overall ticked up by 6.6 percent in Miami-Dade in April, with 10,392 compared with 9,751 in March. In Broward, pending home sales increased from 8,173 in March to 8,525 in April, up 4.3 percent.

Those increases represent huge leaps over last year's numbers. In Miami-Dade, pending sales increased 71 percent year over year; the jump was 64 percent in Broward, figures that point to a recovering market, real estate agents and analysts say.

Sales have increased for the past few months as home prices have fallen.

NEARING BOTTOM?

Independent housing analyst Jack McCabe said the market is likely nearing the bottom, but still must deal with foreclosures and short sales, which keep prices low.

``I think we're going to see a pretty decent year as far as sales numbers, but I don't see prices going up,'' he said.

``The state of paralysis, I think, is pretty much over,'' said Terri Bersach, chairman of the association, which released the data with the Southeast Florida Multiple Listing Service.

Nationally, pending home sales increased in March. The index of sales contracts by the National Association of Realtors rose 5.3 percent from February and 21 percent over last March.

DROP PREDICTED

The national association's chief economist, Lawrence Yun, predicted a drop in sales in the near future.

But South Florida agents say they aren't too concerned about the expired credit.

Jo-Ann Forster, a broker associate with Esslinger Wooten Maxwell, said the tax credit was attractive to buyers looking at less expensive properties.

``If you're going to take all of Miami-Dade into consideration, you're going to see a drop-off,'' Forster said. ``If you take our niche markets, I don't think it's going to have a cataclysmic reaction.''

Anthony Askowitz, a broker and owner of two Re/Max offices, said the timing is good because May and June are typically busy sales months.

``If Miami had a season, this is definitely the big season,'' he said.

Source: http://www.miamiherald.com/2010/05/05/1613443/pending-home-sales-jump.html

By HANNAH SAMPSON

hsampson@MiamiHerald.com

Miami, Miami Beach, real estate

florida,

miami,

miami beach,

rise,

sales

Friday, May 7, 2010

Home renovators alert: House passes 'cash-for-caulkers' bill

Homeowners could collect thousands of dollars in Cash for Caulkers rebates for renovating their homes with better insulation and energy-saving windows and doors under a new economic stimulus bill the House passed Thursday.

The Home Star bill, passed 246-161, would authorize $6 billion over two years for a program that supporters — mostly Democrats — said would have the added benefits of invigorating the slumping construction industry and making the earth a little cleaner.

"Home Star is that solid investment that's going to achieve that hat trick of energy savings for the homeowner, of moving toward a cleaner environment and of creating jobs here at home," said bill sponsor Peter Welch, D-Vt.

Republicans overwhelmingly opposed the bill, and they were able to attach a condition that it would be terminated if Democrats do not come up with a way to pay for it.

The measure has come to be dubbed Cash for Caulkers, a takeoff on the popular 2009 Cash for Clunkers initiative that rewarded people for replacing gas-guzzling vehicles with more fuel-efficient models.

President Barack Obama has promoted the bill, which also needs Senate approval.

The initiative is separate from an energy tax credit of up to $1,500 that was included in last year's economic stimulus act. That credit for energy efficiency improvements runs through the end of this year.

Supporters estimate that 3 million households would make use of the new program, saving $9.2 billion in energy costs over a 10-year period. They said it would create 168,000 jobs, mainly in the recession-hit construction industry.

"Nearly one in four workers in the home construction and services industry has been laid off," said Energy and Commerce Committee chairman Henry Waxman, D-Calif. "Passing Home Star says, 'Help is on the way."'

Republicans were more skeptical, saying the price tag was too high at a time of mounting federal debts.

"We are going to authorize $6.6 billion of money we don't have so we can caulk homes?" asked House Republican leader John Boehner of Ohio.

"This is not a terribly bad bill, but it has one fatal flaw: It is not paid for," said Rep. Joe Barton of Texas, top Republican on the energy committee. Democrats argued that the issue of paying for the legislation will come later in the budgetary process, when Congress approves annual spending bills.

Republicans succeeded at the end of the debate in altering the bill to say it will be terminated if it is found to drive up the federal deficit, a provision that will force Democrats to come up with an offset. The Republicans also were able to alter the legislation so that the rebates would go directly to homeowners. In the original version, homeowners were to receive a discount or rebate from a retailer or contractor, who then would apply for payment from the government.

In debate on the bill, Republicans questioned whether the government can run the rebate program fairly and effectively. They said a $4.7 billion weatherization program that was part of last year's economic stimulus act has been slow to provide grants to states.

The Cash for Clunkers program, too, had some problems. An Associated Press study last November found that the program was commonly used by people turning in old pickups for new trucks that got only marginally better gas mileage.

Under Home Star, rebates or discounts would be provided to homeowners at the time of sale. The retailer or contractor then would submit documentation to a processing office which would verify the information and forward the request to the Energy Department for payment.

To prevent fraud, the program would require licensing for all participating contractors and a certain percentage of projects would be inspected.

The bill has two parts: The Silver Star program provides upfront rebates of up to $3,000 for specific energy-efficient improvements in homes, such as installing energy-efficient appliances or duct sealing, insulation or new windows or doors.

A Gold Star program would entitle people to up to $8,000 when they conduct comprehensive energy audits and implement measures that reduce energy use throughout their homes by more than 20 percent.

The bill has the backing of a wide spectrum of environmental and business groups.

"There is strong evidence that temporary, targeted incentive programs like Home Star can generate jobs, investment and economic growth," National Association of Manufacturers president John Engler said at a hearing in March.

With House passage, the bill moves to the Senate, where it most likely will be attached to the next jobs bill.

The legislation also would approve $600 million over two years for grants to states for programs to replace mobile homes with more energy efficient models.

Source: http://www.sun-sentinel.com/business/fl-cash-for-caulkers-20100506,0,3894298.story

By Jim Abrams, Associated Press Writer

The Home Star bill, passed 246-161, would authorize $6 billion over two years for a program that supporters — mostly Democrats — said would have the added benefits of invigorating the slumping construction industry and making the earth a little cleaner.

"Home Star is that solid investment that's going to achieve that hat trick of energy savings for the homeowner, of moving toward a cleaner environment and of creating jobs here at home," said bill sponsor Peter Welch, D-Vt.

Republicans overwhelmingly opposed the bill, and they were able to attach a condition that it would be terminated if Democrats do not come up with a way to pay for it.

The measure has come to be dubbed Cash for Caulkers, a takeoff on the popular 2009 Cash for Clunkers initiative that rewarded people for replacing gas-guzzling vehicles with more fuel-efficient models.

President Barack Obama has promoted the bill, which also needs Senate approval.

The initiative is separate from an energy tax credit of up to $1,500 that was included in last year's economic stimulus act. That credit for energy efficiency improvements runs through the end of this year.

Supporters estimate that 3 million households would make use of the new program, saving $9.2 billion in energy costs over a 10-year period. They said it would create 168,000 jobs, mainly in the recession-hit construction industry.

"Nearly one in four workers in the home construction and services industry has been laid off," said Energy and Commerce Committee chairman Henry Waxman, D-Calif. "Passing Home Star says, 'Help is on the way."'

Republicans were more skeptical, saying the price tag was too high at a time of mounting federal debts.

"We are going to authorize $6.6 billion of money we don't have so we can caulk homes?" asked House Republican leader John Boehner of Ohio.

"This is not a terribly bad bill, but it has one fatal flaw: It is not paid for," said Rep. Joe Barton of Texas, top Republican on the energy committee. Democrats argued that the issue of paying for the legislation will come later in the budgetary process, when Congress approves annual spending bills.

Republicans succeeded at the end of the debate in altering the bill to say it will be terminated if it is found to drive up the federal deficit, a provision that will force Democrats to come up with an offset. The Republicans also were able to alter the legislation so that the rebates would go directly to homeowners. In the original version, homeowners were to receive a discount or rebate from a retailer or contractor, who then would apply for payment from the government.

In debate on the bill, Republicans questioned whether the government can run the rebate program fairly and effectively. They said a $4.7 billion weatherization program that was part of last year's economic stimulus act has been slow to provide grants to states.

The Cash for Clunkers program, too, had some problems. An Associated Press study last November found that the program was commonly used by people turning in old pickups for new trucks that got only marginally better gas mileage.

Under Home Star, rebates or discounts would be provided to homeowners at the time of sale. The retailer or contractor then would submit documentation to a processing office which would verify the information and forward the request to the Energy Department for payment.

To prevent fraud, the program would require licensing for all participating contractors and a certain percentage of projects would be inspected.

The bill has two parts: The Silver Star program provides upfront rebates of up to $3,000 for specific energy-efficient improvements in homes, such as installing energy-efficient appliances or duct sealing, insulation or new windows or doors.

A Gold Star program would entitle people to up to $8,000 when they conduct comprehensive energy audits and implement measures that reduce energy use throughout their homes by more than 20 percent.

The bill has the backing of a wide spectrum of environmental and business groups.

"There is strong evidence that temporary, targeted incentive programs like Home Star can generate jobs, investment and economic growth," National Association of Manufacturers president John Engler said at a hearing in March.

With House passage, the bill moves to the Senate, where it most likely will be attached to the next jobs bill.

The legislation also would approve $600 million over two years for grants to states for programs to replace mobile homes with more energy efficient models.

Source: http://www.sun-sentinel.com/business/fl-cash-for-caulkers-20100506,0,3894298.story

By Jim Abrams, Associated Press Writer

Miami, Miami Beach, real estate

apartments,

Bill,

home star,

homes,

miami,

miami beach

Thursday, May 6, 2010

Solar Mountain developers have big plans

The group interested in buying $190 million in debt tied to the North Miami site of the defunct Biscayne Landing project is proposing to reduce the money it would owe the city by more than $15 million.

The money is tied to a series of city agreements that dictate everything from the rent on the site’s 200-year lease to $28 million Biscayne Landing’s developer agreed to pay the city separately for the right to develop the former landfill into a community of offices, retail and 6,000 residences.

Solar Park Management Corp., which won the auction on the debt last month with a more than $30 million bid, is proposing to reduce its overall payments to the city. The company wants to build an indoor ski and tennis center on the site.

Instead of $25 million for the city’s museum, library and sports training facility, Solar Park, now called Solar Mountain, proposes to pay $7.5 million on unrestricted money.

Additionally, the site’s rent would max out at $4 million a year, instead of $4.2 million.

One feature of the economic study the group submitted to the city also references $795,000 in operating expenditures the city will make on “behalf of the residents, visitors and employees of the development.”

Solar Mountain’s proposal does not address the money the developer is currently required to pay the city for the residences and commercial space it develops in the future.

What would the city get in return? Various payments, including rent to the city during the first 15 months after execution of the new lease would be $12.5 million, which could deliver the money faster than the current payment schedule requires.

Additionally, because there would be no use restrictions on the $7.5 million, the money could be used to shore up the city’s budget, which has a shortfall into the millions.

The city would also get 25 cents from every ticket sold for the park, according to the group’s proposal to the city.

The speed of delivery and the unrestricted use would be attractive to North Miami, which, like every local municipality, is struggling to find millions to shore up its budget, said city Finance Director Carlos Perez, who noted he had not reviewed Solar Mountain’s proposal.

“Where are we going to get $795,000 when we are already [millions] in the hole?” asked Carol Keys, a North Miami resident and owner of Keys Title Co. She said she is worried the city could agree to the changes, reducing its revenue stream for a project that never gets off the ground, which would then be difficult to change again.

Former North Miami Community Redevelopment Agency head Frank Schnidman said allowing the changes without making them contingent on project approval would leave the city vulnerable to a lot of problematic unknowns. Schnidman, a senior fellow at Florida Atlantic University’s Center for Urban Environmental Solutions, said Solar Mountain could not build anything and flip the lease to another group, and the city would be out the millions of dollars that were promised as part of the project.

To buy into Solar Mountain’s vision for the former landfill where Biscayne Landing was planned would require a massive overhaul of the documents that dictate what can be done on the vacant 190-acre site. The economy and the residential real estate meltdown has made it clear that the community of residences, retail and offices once planned for the site, adjacent to Florida International University, is not viable.

Agreeing to Solar Mountain’s vision would also require a revolutionary change in the city’s philosophy. The original vision was not only a way to rehabilitate the former federal Superfund site, but taxes generated by the project were designed to bolster a city with few revenue generators and serve as fuel for North Miami’s burgeoning affordable housing program.

If the buying group can get the restrictions eliminated or reduced, and a new lease, the land’s value would increase significantly, real estate experts say.

The changes would depend on a city council that includes Mayor Andre Pierre. Pierre is the former law partner of Solar Mountain President Marc A. Douthit. Solar Mountain’s VP is Willis Howard, Pierre’s campaign manager for his successful 2009 run. The Pierre connections have prompted concern from some residents that the group is packed with insiders who will get a sweetheart deal.

Both Douthit and Howard insist they have done everything in a transparent way, and that they have put equity and their reputations into the deal, which will ensure the best outcome for the city.

The Solar Mountain project, which is projected to open in 2013, could generate 5,530 construction jobs and has a potential economic impact of $360 million in Miami-Dade County, according to Fishkind & Associates. The Orlando-based firm, which produced an economic study for the buying group, also said the park would generate 480 on-site jobs. Additionally, if there is market demand for residences, the developer could produce 727 multifamily units for a population of about 1,300.

The buying group estimated Solar Mountain's first-year attendance at 2.5 million visitors.

Source: http://southflorida.bizjournals.com/southflorida/stories/2010/05/03/daily75.html

The money is tied to a series of city agreements that dictate everything from the rent on the site’s 200-year lease to $28 million Biscayne Landing’s developer agreed to pay the city separately for the right to develop the former landfill into a community of offices, retail and 6,000 residences.

Solar Park Management Corp., which won the auction on the debt last month with a more than $30 million bid, is proposing to reduce its overall payments to the city. The company wants to build an indoor ski and tennis center on the site.

Instead of $25 million for the city’s museum, library and sports training facility, Solar Park, now called Solar Mountain, proposes to pay $7.5 million on unrestricted money.

Additionally, the site’s rent would max out at $4 million a year, instead of $4.2 million.

One feature of the economic study the group submitted to the city also references $795,000 in operating expenditures the city will make on “behalf of the residents, visitors and employees of the development.”

Solar Mountain’s proposal does not address the money the developer is currently required to pay the city for the residences and commercial space it develops in the future.

What would the city get in return? Various payments, including rent to the city during the first 15 months after execution of the new lease would be $12.5 million, which could deliver the money faster than the current payment schedule requires.

Additionally, because there would be no use restrictions on the $7.5 million, the money could be used to shore up the city’s budget, which has a shortfall into the millions.

The city would also get 25 cents from every ticket sold for the park, according to the group’s proposal to the city.

The speed of delivery and the unrestricted use would be attractive to North Miami, which, like every local municipality, is struggling to find millions to shore up its budget, said city Finance Director Carlos Perez, who noted he had not reviewed Solar Mountain’s proposal.

“Where are we going to get $795,000 when we are already [millions] in the hole?” asked Carol Keys, a North Miami resident and owner of Keys Title Co. She said she is worried the city could agree to the changes, reducing its revenue stream for a project that never gets off the ground, which would then be difficult to change again.